The H&K Group

Client Profile

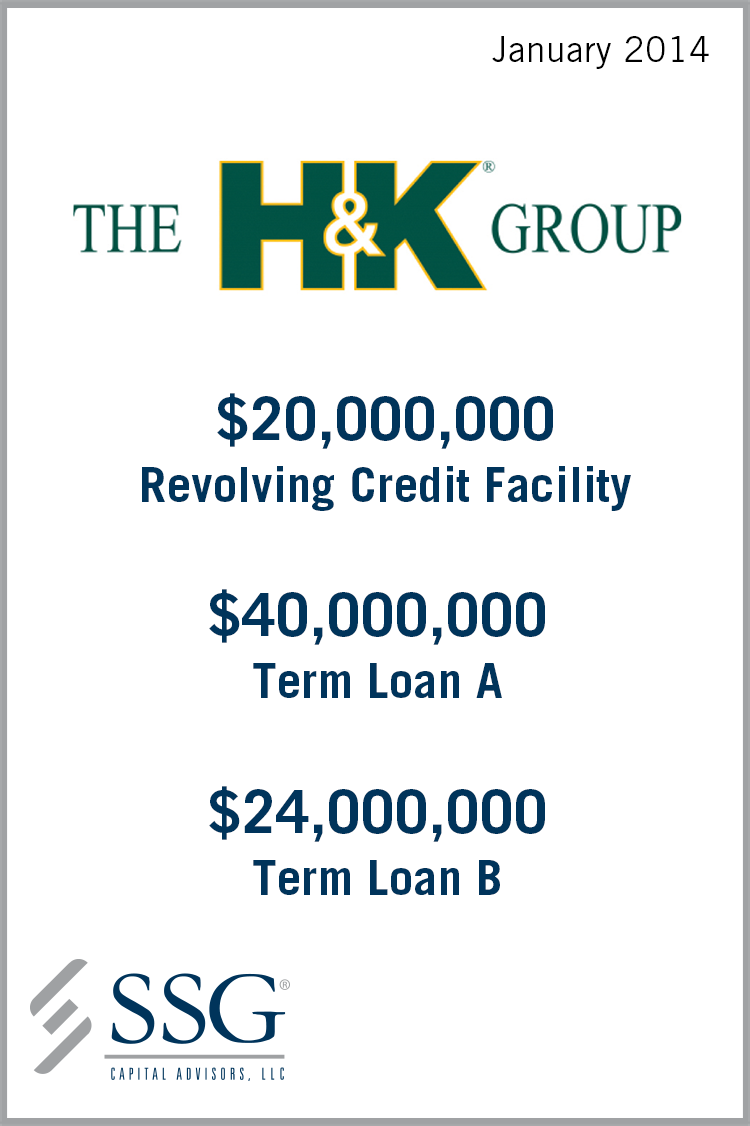

SSG Capital Advisors, LLC (“SSG”) acted as the exclusive investment banker to The H&K Group (“H&K” or the “Company”) in the placement of a financing package which enabled the Company to refinance existing indebtedness and generate additional liquidity for growth. The transaction closed in January 2014.

Situation

H&K is one of the largest construction materials and full-service site contracting providers in the Mid-Atlantic region. The Company plays a critical role in supplying the commercial construction, infrastructure development, and residential building sectors with contracting services and construction materials. Headquartered in Skippack, PA, H&K is a group of vertically integrated family-owned and operated companies with over 80 locations throughout Pennsylvania, New Jersey, Maryland and Delaware, including 18 quarries. H&K has two main divisions, Contracting and Materials. The Company’s Contracting division offers a wide variety of services which enables it to handle projects of any magnitude, from initial groundbreaking through final site applications. The Contracting division is a full-service, turn-key provider of site contracting, paving and milling, commercial and industrial demolition, underground utility installation, retaining wall installation, bridge and heavy highway construction, construction drilling, commercial paving, roll-off containers, solid waste services, water and wastewater services, and natural gas well pad construction. H&K’s Materials division offers a wide variety of construction and landscape materials servicing numerous customers across a variety of industries. Construction materials include crushed stone, sand and gravel, crushed stone rail delivery and railroad ballast, asphalt blacktop production, a variety of concrete products, natural stone products, environmentally friendly recycled concrete, fill material and hauling services. With pending debt maturities, the Company required a new financing package to provide it with a stable capital structure that could support continued growth.

Solution

SSG was retained in 2013 to work with the Company to source a new lending relationship. After canvassing the credit markets and delivering multiple options, SSG facilitated an $85 million credit facility for the Company, consisting of a $20 million working capital revolver, $40 million term loan A and $25 million term loan B.